If you are exactly equal to the peak bone mass of an average 30-year-old, you do not deviate at all from the average so your T-score would be 0 standard deviations (SD). One standard deviation is equal to a 10–12% difference in bone mass. The manufacturers of the DXA machines have programmed them to use a formula to compute these values. The score that you receive from your bone density (BMD or DXA) test is measured as a standard deviation from the mean. The results for the entire population will be distributed around an average score (the mean).Ī T-score is a standard deviation - a mathematical term that calculates how much a result varies from the average or mean.

/10b447af-71bc-417e-ac7d-7f769a0138fa.png)

A bone density test is like any other medical test or measurement. The T-score on your bone density report shows how much your bone mass differs from the bone mass of an average healthy 30 year old adult.Find out how GoCardless can help you with ad hoc payments or recurring payments. GoCardless helps you automate payment collection, cutting down on the amount of admin your team needs to deal with when chasing invoices.

#Z score definition how to#

Analysing z-score examples can give investors and business owners an idea of their utility, function, as well as how to calculate z-score for financial planning and investment. The type of table you choose will depend on the data derived from your calculations and the financial trends it reveals.Ī z-score table displays the relationship between the data in a visual format and supports the analysis and decision-making process. And accordingly, a negative table is used for negative z-scores scores appearing to the left of the mean. If your z-scores are positive, you’ll use the positive z-score table that shows the values to the right of the mean.

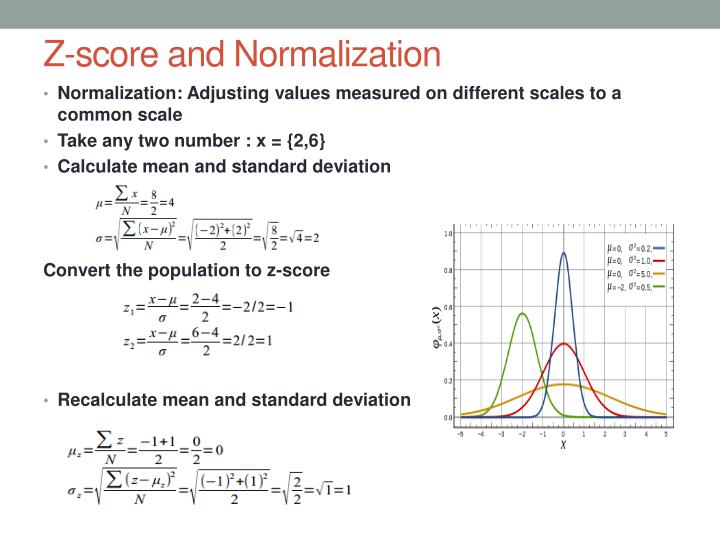

A z-score table, also called a standard normal table, shows the percentage of values above (to the right) or below (to the left) a z score on a standard normal distribution. In graph format, z-scores can be plotted on a normal distribution curve. Standard scores are represented visually in graphs and tables. The calculation used to determine the z-score from this information is:Ĭ = Earnings before interest and taxes (EBIT) / total assetsĭ = Market value of equity / book value of total liabilities This information can be found in a company’s financial accounting documents and on the Annual Return (AR1). In the financial sector, the z-score formula is more complex as it’s based on five key financial ratios. Z-score, however, represents the number of standard deviations a specified data point lies from the mean. Standard deviation is a calculation of the amount of variability within a specified set of data.

standard deviation: what’s the difference? A score of 3 or higher indicates financial stability, and that the company has the potential to be a solid investment choice. In the financial sector, a z-score of 1.8 or lower indicates that a company may be headed for bankruptcy and, as such, potentially represents an unwise investment. They also make it possible for scores to be adapted from various data sets so that they can be compared to one another more accurately. Z-scores indicate if a value is typical or atypical for a data set. Technically speaking, a z-score is a statistical measurement that shows a value's relationship to the mean. In addition to being a credit-strength test, z-scores are now used by traders to predict market volatility and by investors assessing the financial health of businesses. Altman’s goal was to determine the likelihood of bankruptcy of publicly traded companies. Also known as a standard score, New York University professor Edward Altman developed the z-score in the late 1960s. You see a promising investment opportunity, but you want assurance that the company isn’t going to go belly-up with your money.

0 kommentar(er)

0 kommentar(er)